The controversial tariffs have been imposed and many are unsure of what the consequences will be for the solar industry and its investors.

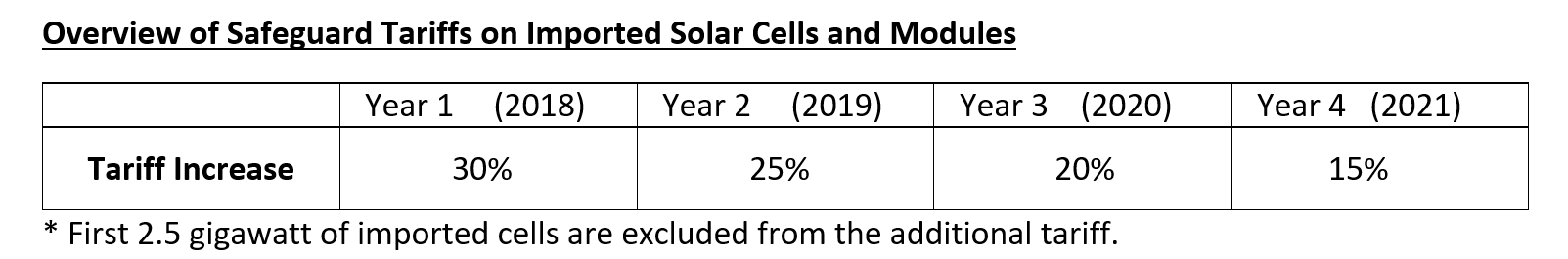

Though the 30% tariff on imported solar panels may seem high, and will undoubtedly increase the cost of going solar, it will not undermine the benefit of going solar for homeowners.

The import tariff is supposed to go into effect February 7, 2018, however, it could take up to 90 days for the new pricing to be reflected. So if you were planning to go solar, but haven’t already, now is the time to invest before prices go up.

Nevertheless, when you break down the total cost of going solar, material cost is only about a third of the cost of the solar installation, the rest is divided between labor and overhead costs, which are not subject to change. So what you’re really looking at is about a 5 – 10% increase in the overall cost which could be up to $500 more for a 2.6 kW (8 panel) system and up to $4,000 more for a 12.8 kW (40 panel) system with premium panels.

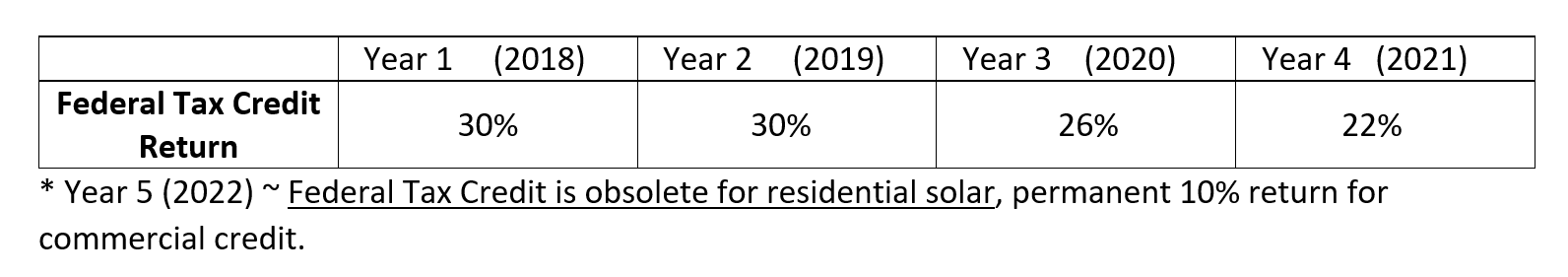

However, the 30% Federal Tax Credit incentive is still in effect, so in the end, you’re looking at roughly a 3.5 – 7% increase. (~$350 – $2,800) Overall, the payback period might take a few more months to a year, but the high return on investment would still make it well worth the endeavor to go solar. Just don’t wait too long because the 30% FTC is phasing out!

Luckily, pre-tariff pricing is still available, but not for long. So if you know you want to go solar, NOW is THE best time to consider and invest in solar so that you get the greatest value on your return.

If you request an estimate today, we can provide you with our pre-tariff pricing that is effective for 30 days. It’s free! So, why not at least find out the potential benefit before the 30% tariff kicks in??